Financial

2024 Mar 22 - 07:04

- Key figures in 2023:

- Consolidated net profit of €766m (€651m at 31 December 2022 as calculated with the accounting standards previously in effect)

- Higher dividend of €0.165 per share compared to €0.16 in 2022

- Combined Ratio 98.2%

- Individual solvency ratio 313%

- UnipolSai has consolidated its commitment to support sustainable development and the ecological transition:

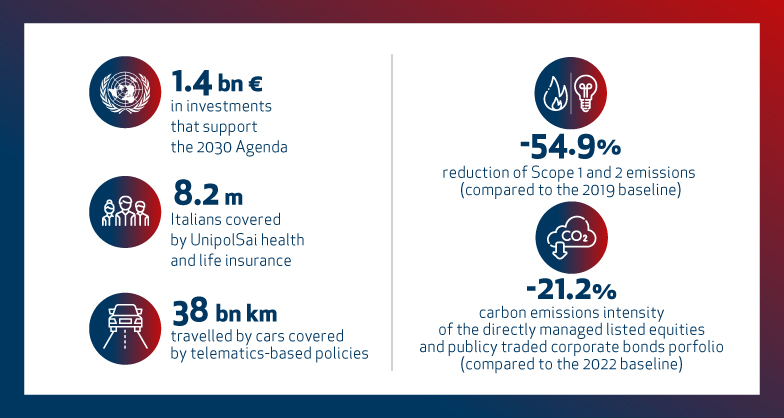

- 8.2 million Italians (14% of the population) covered by UnipolSai Welfare (Life and Health) insurance

- €1.4bn in investments to support the 2030 Agenda (target of €1.3bn in investments by the end of 2024 as per the 2022-2024 Strategic Plan exceeded)

- At 2023 year-end, 54.9% reduction (compared to 2019) in Scope 1 and 2 emissions linked to the consumption of electricity, gas and other energy sources for all buildings under direct control and the fleet of cars used by Group employees (the target was a reduction of 46.2% by 2030)

- Reduction of 21.2% at 2023 year-end (compared to 20222) in the carbon emission intensity of the directly managed listed equities and publicly traded corporate bonds portfolio (target 50% reduction by 2030).

- 360° support for more efficient, safe and sustainable mobility: about 38 billion km travelled by cars covered by telecommunication-based policies

- Standard Ethics gave UnipolSai a long term expected rating of EEE-, classifying it as one of the best companies in the world in terms of social and environmental sustainability

- Proposed merger of UnipolSai Assicurazioni, Unipol Finance, UnipolPart I and Unipol Investment into Unipol Gruppo approved. Share exchange ratio of 3 Unipol Gruppo shares for every 10 UnipolSai shares confirmed

Please read the complete Press Release.